Driven by Themes and People.

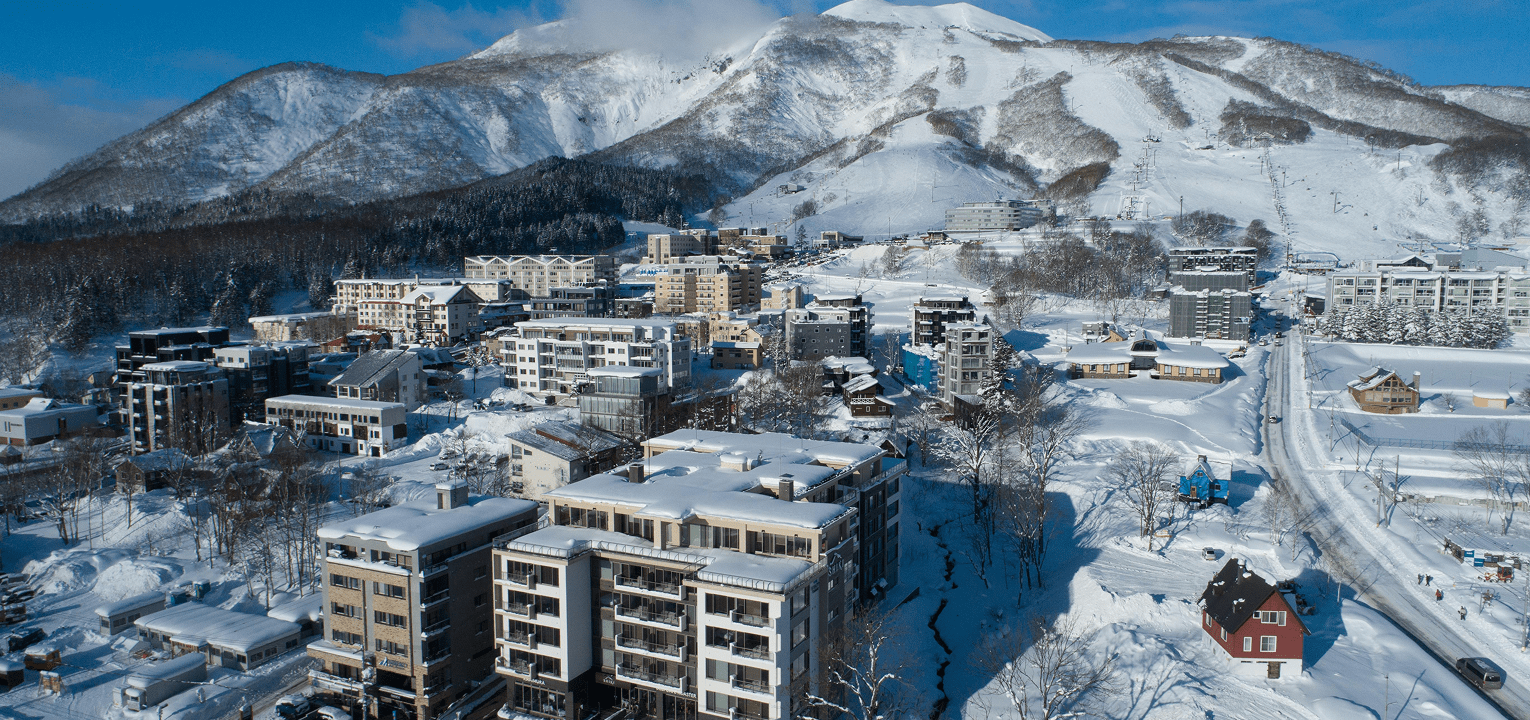

APAC based real assets investment firm, committed to delivering exceptional returns across the risk spectrum.

Our Story

In 2025, Capitarea was established to capitalize on thematic opportunities via 2 key strategies.

Sponsor and management track-record spans 100 years across geographies and sectors. As a result, our network and deep market insights offers Capitarea unique opportunities in the APAC private assets space.

We are committed to transparency, communication and on-ground collaboration with project stakeholders.

portfolio diversification

Companies, individuals, and institutions often frame investment decisions through the lenses of geography, sector, asset class, and risk-return. Here’s why we believe APAC as a region, private markets as a mode of access, and real assets as an asset class each warrant distinct attention

APAC

Economic Diversification: APAC economic growth remains weakly correlated with Western economies. Intra-regional pairwise correlations within APAC economies are also lower than EU.

Asset Class Diversification: APAC RE consistently displays low to negative correlations with other APAC asset classes.

Real Assets

These are physical assets with intrinsic worth due to their substance and property, such as infrastructure and real estate. These solutions can be found in both public and private markets and provide opportunities for portfolio diversification, income streams and inflation hedging.

Private market

Private markets experience reduced volatility and generate long-term illiquidity premiums. While public markets benefit from lower-cost debt capital, private markets provide a broader and more flexible risk-return spectrum.

Our Sponsor

2.5 + Million Net lettable Area (SF)

2.4 + Billion gross development value (USD)

Countries with transaction and management experience.

Asset Enhancements since 1995